SPECIALIZED SOLUTIONS

GAIN TRACTION AMID

UNCERTAINTY

Direct Indexing and Alternatives

in High-Net-Worth Portfolios

SPECIALIZED SOLUTIONS

GAIN TRACTION AMID UNCERTAINTY

Direct Indexing and Alternatives in High-Net-Worth Portfolios

INTRODUCTION

Advisors encounter a complex and dynamic mix of market-moving forces as they help clients navigate the ever-changing investment landscape. Elevated uncertainty and related volatility in the recent climate underscore this point. Rising to the challenge requires advisors to plan strategically while diversifying portfolios within the context of each client’s circumstances, risk tolerance and goals.

High-net-worth (HNW) clients call for advanced levels of customization as client-specific concerns such as risk management, tax planning and wealth transfer take on added significance. Based on data from Cerulli, tax minimization and wealth preservation in particular rank as “very important” investment objectives for roughly three-quarters of HNW practices.1

According to leading advisors, direct indexing and alternative solutions are playing increasingly vital roles in their efforts to position portfolios to address the HNW category’s unique demands. For the second consecutive year, PGIM partnered with SHOOK® Research to survey more than 200 of SHOOK’s top-ranked advisors for firsthand feedback on these strategies as trends in usage, attitudes and intentions evolve.

VIEWS AMID VOLATILITY

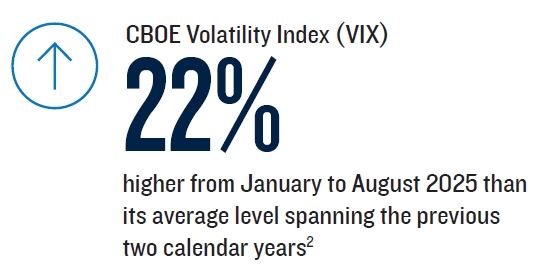

Relative calm gave way to hair-trigger volatility in early 2025 when “Liberation Day” renewed inflation worries mere months after the Fed appeared to signal the end of one of its all-time fiercest fights against price pressure. The CBOE Volatility Index (VIX) was 22% higher from January to August 2025 than its average level spanning the previous two calendar years.2

Our 2025 survey was conducted during the elevated market volatility surrounding the new tariff-driven trade policy introduced by the U.S., a period that helped introduce widespread uncertainty as one of 2025’s defining themes. With this backdrop in mind, the research findings show advisors inclined to increase their embrace of direct indexing and alternatives amid conditions that strengthen the cases for both.

AFTER-TAX OPPORTUNITIES

A notable majority of surveyed advisors consider periods marked by heightened volatility as opportune times to ramp up usage of tax management strategies such as direct indexing.

Increased interest in direct indexing shouldn’t surprise tax-minded market watchers. The S&P 500’s tax-loss harvesting potential in 2025 has been more than double its long-term average. Large and volatile sectors, including technology, consumer discretionary and communication services, have offered even greater opportunities, exceeding 20%.3

DEMAND FOR DIVERSIFICATION

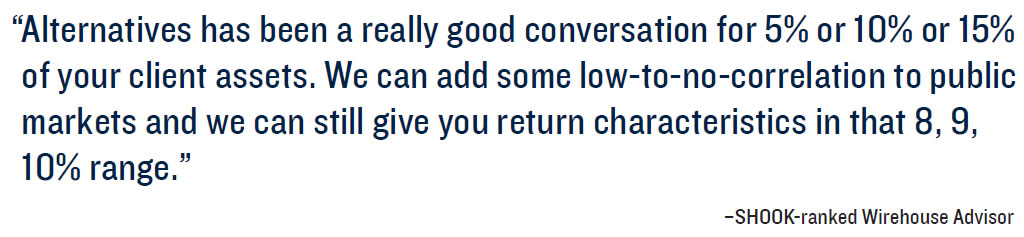

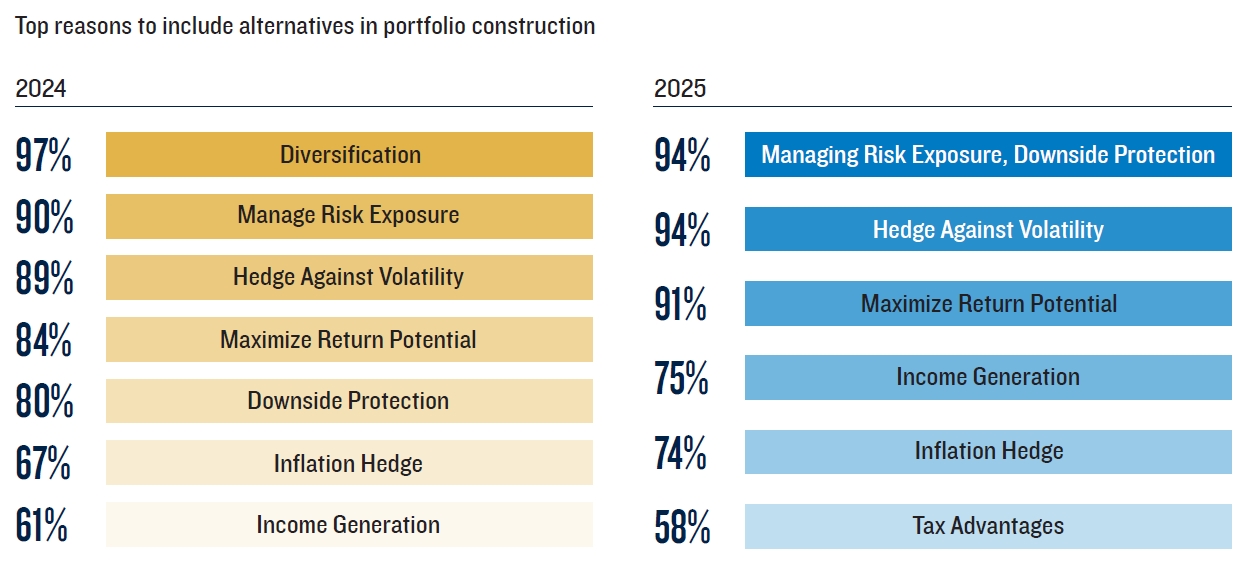

While alternatives are common in the HNW portfolios of surveyed advisors, respondents reinforced their commitments, particularly in ways that aligned with concerns related to uncertain market conditions.

Reaching near-consensus levels, advisors are more likely to describe their reasoning for allocating to alternatives for “managing risk exposure” and as a “hedge against volatility” than they were in the previous survey.

DIRECT INDEXING CONTINUES TO GAIN TRACTION

Direct indexing continues to capture significant attention across the U.S. wealth management industry, fueled by rapid asset growth and heightened discussion in the media.

While total assets reached $864.3 billion by year-end 2024, 4 broad adoption has not yet matched industry enthusiasm. Currently, only 18% of advisors report using direct indexing strategies, with 23% planning to use them in the future.4 Despite this, providers that do offer direct indexing have experienced a significant uplift — with a compound annual growth rate of 22.4% from 2021-2024.4

PGIM’s survey of top advisors reveals strong momentum for and successful use of direct indexing. Advisors are increasingly adopting these strategies for client portfolios, particularly for high-net-worth clients seeking tax-minimization strategies.

WHAT TOP ADVISORS SAY ABOUT DIRECT INDEXING:

A Vital Strategy - Direct indexing is a core strategy for advisors to enhance after-tax returns for high-net-worth clients.

Tax Benefits First - When choosing a provider, top advisors prioritize solutions that deliver the strongest tax advantages.

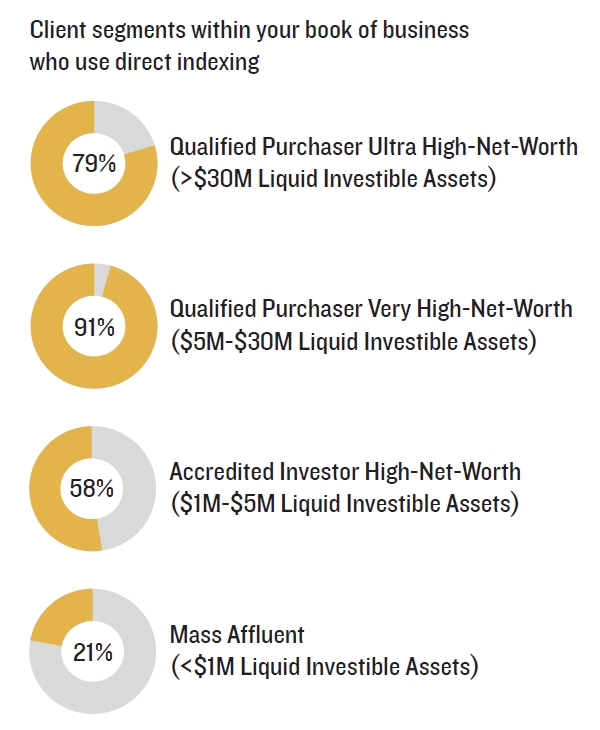

Key Audience - The primary users are high-net-worth clients, typically with over $5 million in assets.

AN INCREASINGLY IMPORTANT TOOL

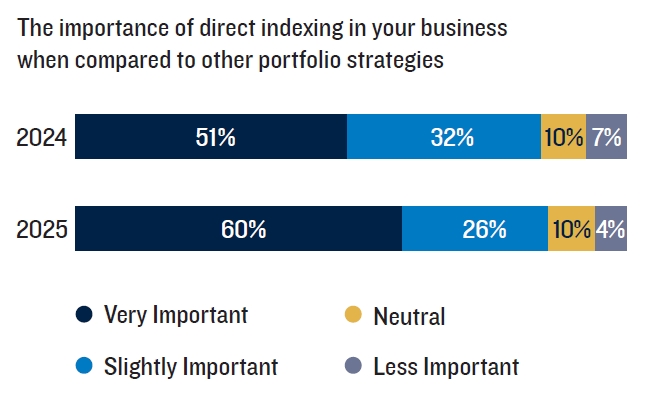

Up from year-ago responses, 86% of advisors consider direct indexing to be an important strategy in HNW portfolio construction. Amid the upturn in market volatility, there is a 9 percentage point increase in the percentage of advisors that describe direct indexing as “very important” than there were last year.

This year-over-year lift confirms a clear trend: top advisors are now leveraging direct indexing as a core tool for customizing client portfolios. The strategy’s adoption is moving to be more mainstream, reflecting its growing importance in wealth management.

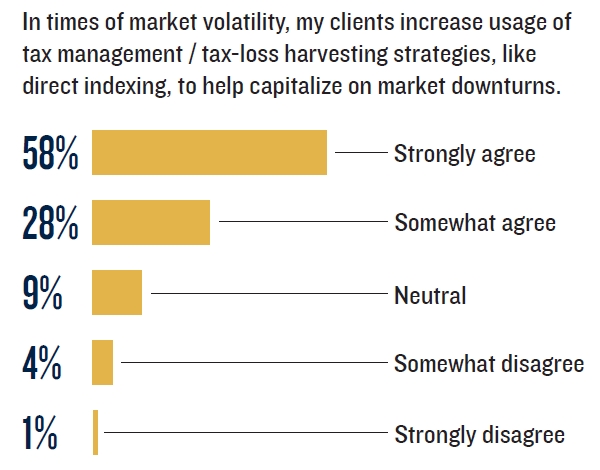

VOLATILITY’S AFTER-TAX UPSIDE

Amid a volatile backdrop, the survey also dove into the impact of market uncertainty on advisors’ usage of tax management strategies. Advisors decidedly confirm that periods of increased volatility spur increased client use of tax-loss harvesting solutions, with 86% agreeing that clients accelerate usage of strategies such as direct indexing to capitalize on market downturns. Roughly six in 10 respondents are emphatic enough to “strongly agree” with that sentiment.

EVOLVING USAGE TRENDS

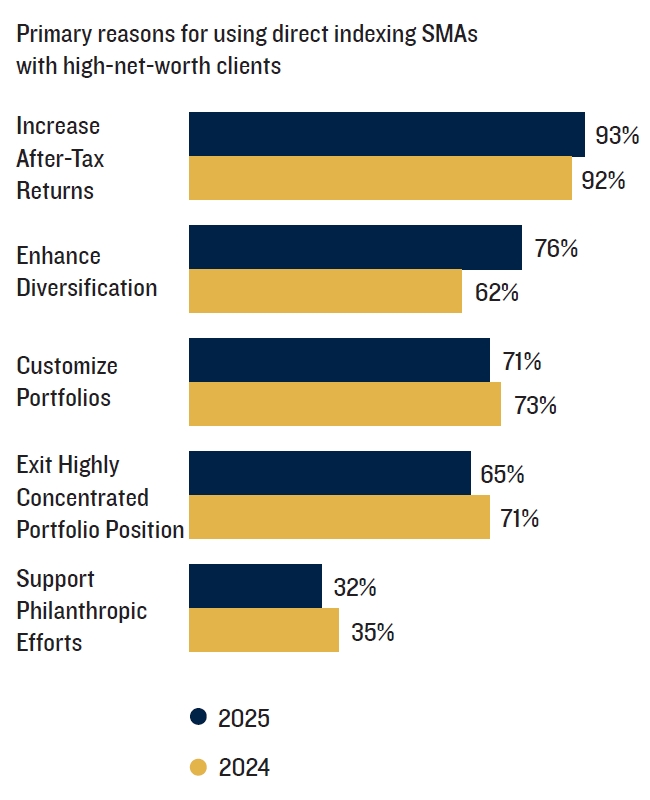

While there are many stated benefits to direct indexing, the primary reason advisors employ direct indexing strategies on behalf of clients remains unchanged, with the overwhelming majority citing the ability to increase after-tax returns. Beyond that, responses reveal a seismic shift in advisor motivation, as more than three-quarters of respondents say they use direct indexing to enhance diversification, representing a 14-point increase over previous survey results.

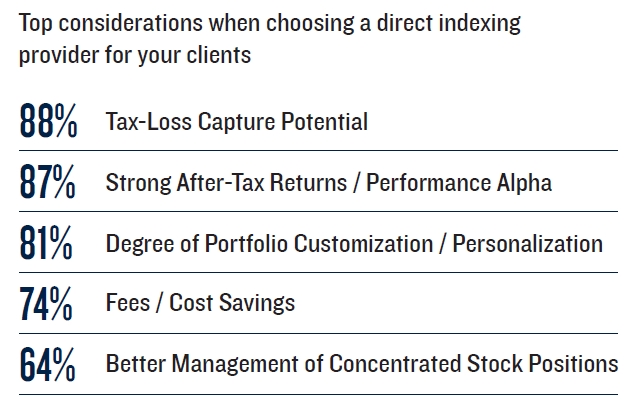

PROVIDER SELECTION ALIGNMENT

Another equally important consideration for advisors is the choice of a provider to help meet the needs of high-net-worth clients. Advisors are solidly aligned in terms of the factors they prioritize when selecting a direct indexing provider. The top reason, tax-loss capture potential, and the next most important influence, after-tax returns, are separated by a single response. Customization / personalization and fees are also important, but slightly less so.

WHO USES DIRECT INDEXING?

We asked advisors about the types of clients that are the most frequent users of direct indexing strategies. Drawing on their own books of business, nine in 10 advisors identify “very high-net-worth” clientele, or clients with between $5 million and $30 million in investable assets, as the strategy’s sweet spot. Direct indexing is also widely employed among clients with assets exceeding $30 million.

CASE STUDY

DIRECT INDEXING: TAX-SMART INVESTING STRATEGY

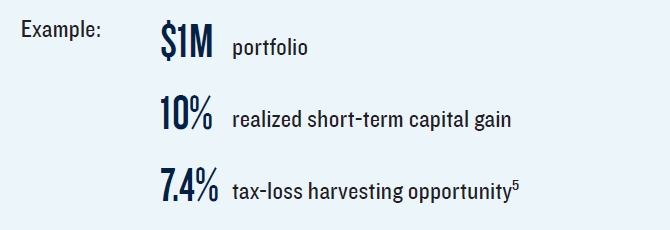

TAX-LOSS HARVESTING CAN REDUCE THE TAX BURDEN

TAX-LOSS HARVESTING

BENEFITS

1. Losses can be used to offset capital gains outside of the portfolio:

- Stocks

- Bonds

- Real Estate

- Commodities

- Cryptocurrency

2. Capital losses can be carried forward indefinitely until exhausted.7

DIRECT INDEXING: ADVANTAGES OF AN ETF-BASED APPROACH

Stronger After-Tax

Return Potential

- ETF-based strategies maintain market exposure with minimal cash drag.

- They substitute in sector-level securities to facilitate tax loss harvesting.

- Stock-based strategies face limitations due to fewer high-weight stocks in indices.

- This reduces harvesting frequency and restricts full position trading

Greater Tax-Loss

Capture Opportunities

- ETF-based direct indexing portfolios can hold fewer securities while regularly turning 100% of the portfolio over to harvest losses.

- By holding fewer securities, ETF-based direct indexing can deliver tax benefits with less trading and tax loss creation than traditional approaches.

- ETF-based approaches can help maximize tax benefits when clients expect them most, particularly during sharp, sudden market declines.

A Simplified

Investor Experience

- ETF-based direct indexing portfolios hold significantly fewer securities.

- They achieve similar market exposure compared to individual stocks which require hundreds of holdings.

- Fewer holdings simplify portfolio analysis and reporting.

ALTERNATIVES ADOPTION IS ACCELERATING

Alternative investments are commanding attention as powerful opportunities amid market volatility. While Cerulli notes that the approximate $16 trillion figure for private investments likely overstates the current addressable market8, the core message is clear: private capital is growing—year after year, and increasingly through intermittent liquidity strategies. In 2024, asset growth and fundraising marked new highs, further establishing private equity and private credit as critical drivers of portfolio transformation.8

As market uncertainty persists, advisors see that these asset classes can deliver differentiated returns and new ways to manage risk. Demand is accelerating, especially among high-net-worth clients looking for more than traditional assets. Advisors continue to ramp up allocations, recognizing that public markets now reflect only a fraction of global opportunities. For investors seeking broad diversification and a comprehensive opportunity set, access to alternatives has become increasingly important.

WHAT TOP ADVISORS SAY ABOUT ALTERNATIVE INVESTING:

Core Objectives

Alternatives are used to manage portfolio risk and maximize return potential.

Growing Allocations

Top advisors are increasing exposure to private equity and private credit.

Manager Selection

Advisors favor managers who prioritize returns, demonstrate deep expertise, and maintain a strong reputation.

Key Audience

Private market strategies are most prevalent among high-net-worth clients with assets between $5 million and $30 million.

GROWING ALLOCATION ALIGNMENT

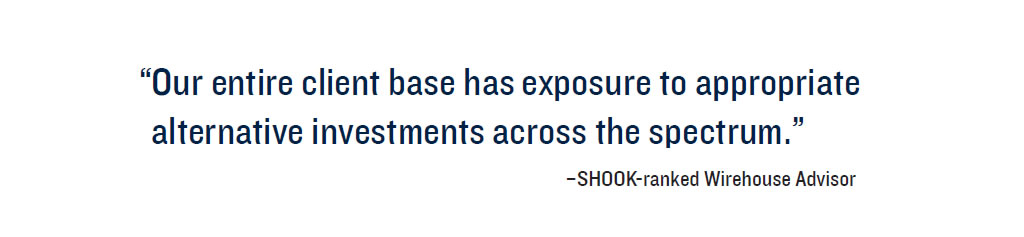

As client assets in alternatives continue to grow, advisors are showing increased agreement on target allocations, with alternative solutions generally accounting for between 6% and 20% of portfolio assets. The most common range is at the lower end of the spectrum at 6% to 10%, but fewer advisors report allocating at the extremes (below 5% and above 20%) than last year.

VALUED FOR VERSATILITY

Amid elevated public market volatility, advisors are more prone to consider alternatives for a wider range of uses versus last year. While top responses align with previous priorities, including managing risk, hedging against volatility and maximizing potential returns, there were notable increases in advisors employing alternatives to generate income and hedge against inflation, up 14% and 7%, respectively.

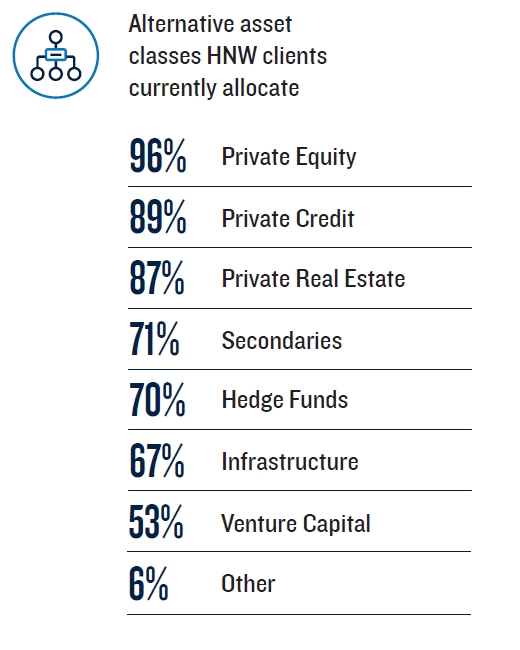

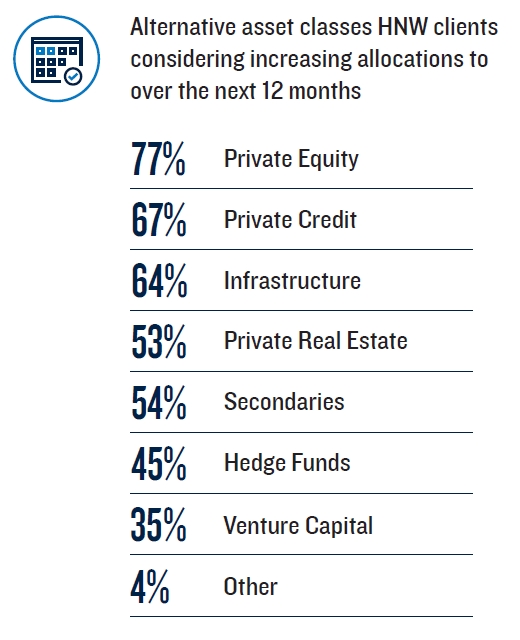

ALTERNATIVE ALLOCATION PREFERENCES

According to Cerulli, investors are searching for returns that outpace inflation and, for retail advisors specifically, access to exposures that were once out of reach. To meet this demand in the retail segment, managers are focusing on building private capital allocations—including private credit, private equity, private real estate and infrastructure.9

Not surprisingly, top advisors surveyed rank private equity, private credit, and private real estate as the leading alternative asset classes for existing allocations. Targets for intended allocation increases follow the same pattern except for the third spot, where infrastructure ranks as a candidate for increased exposure among nearly two-thirds of advisors.

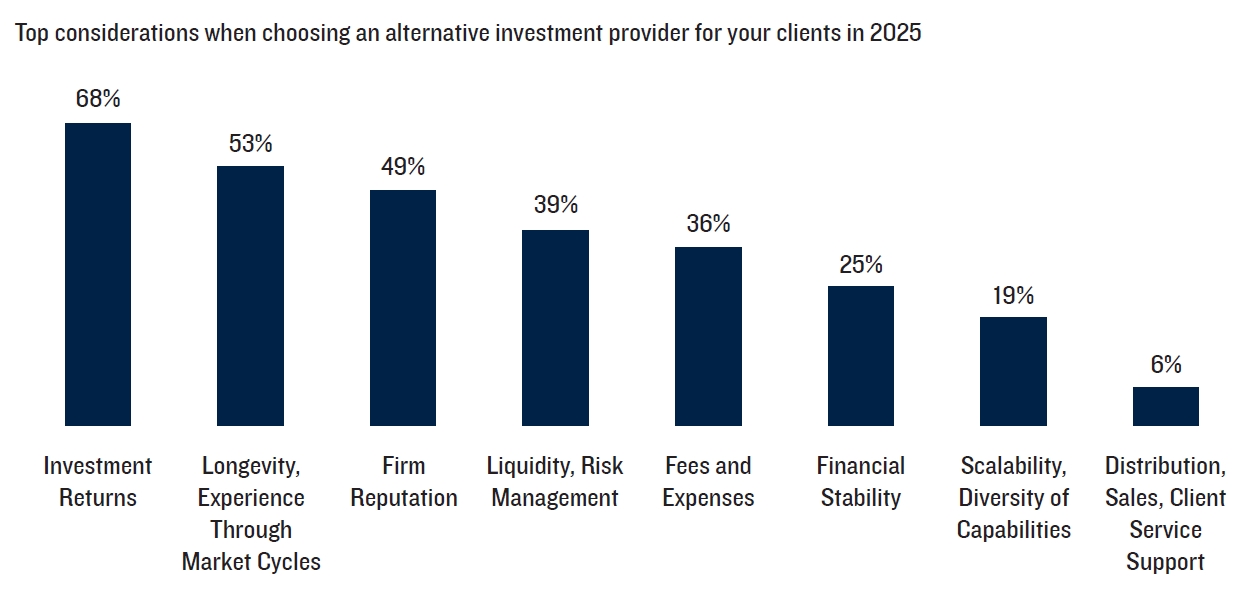

PERFORMANCE, EXPERTISE AND BRAND DRIVE SELECTION

When it comes to choosing alternative investment managers, advisors seek evidence of trusted guides. Track record, experience and reputation rank as the top three considerations advisors rely on to select alternative investment providers for HNW clients.

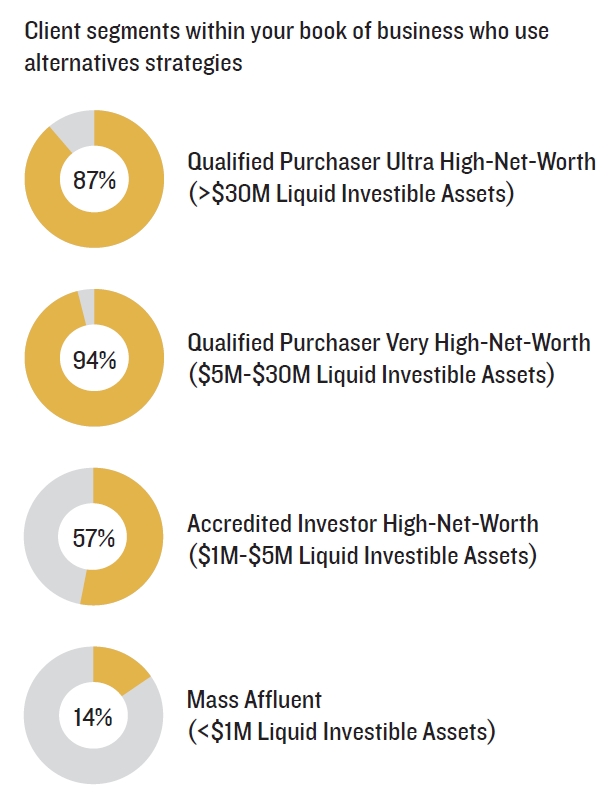

HIGHER NET WORTH IS THE NORM

Alternative solutions are prevalent in client portfolios once assets reach $5 million. Nearly all very HNW portfolios and ultra HNW portfolios maintain alternatives exposure versus just over half of HNW portfolios and slightly over 14% of mass affluent portfolios.

However, as product innovation drives requirements for asset minimums lower, we may start to see a shift in usage within client portfolios below $1 million.

CASE STUDY

PRIVATE CREDIT: AN ATTRACTIVE ALTERNATIVES STRATEGY

Investors seeking to diversify into alternatives to help mitigate the impact of market volatility are increasingly turning to private credit. In a challenging market, private credit is viewed as a potential tool to enhance returns and provide income opportunities.

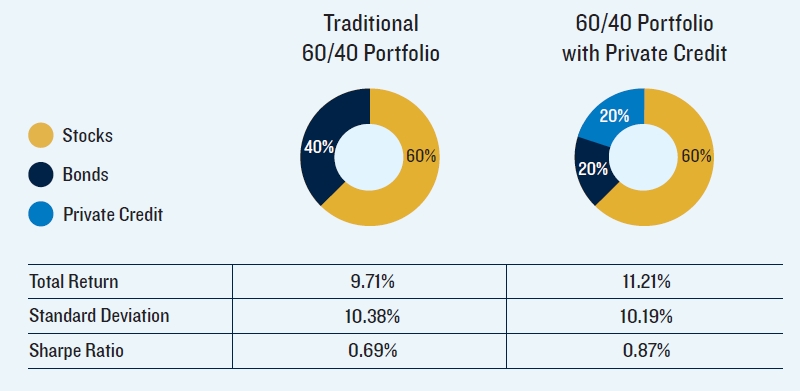

ADDING PRIVATE CREDIT COULD PROVIDE ATTRACTIVE RISK-ADJUSTED RETURNS

PORTFOLIO CONSTRUCTION BENEFITS OF PRIVATE CREDIT

- Private credit may help investors unlock more from their traditional 60/40 portfolio.

- Adding a 20% allocation to private credit has resulted in stronger risk-adjusted returns (in this example, 1.5% more return with less volatility.)

WHY CONSIDER PRIVATE CREDIT?

Strong Historical

Risk-Adjusted Returns

Private credit has demonstrated consistently strong performance over time and market cycles on an absolute basis. It has also historically outperformed traditional assets, providing 94% of the return of a 60/40 portfolio of stocks and bonds with only 28% of the volatility.10

Attractive Inflation-

Hedged Income

Due to the floating nature of the loans, private credit can provide a natural hedge against inflation risk. Private credit also typically offers investors higher current and historical yields than leveraged loans and high yield bonds because of the illiquidity premium.

Structural Benefits vs. Traditional Credit Assets

Since private credit is directly negotiated, it is often customized to offer more structural benefits and terms than traditional fixed income assets to reduce risk.11

ADVISOR VIEWPOINTS ON THE ROLES OF ASSET MANAGERS

As more advisors look to use direct indexing and alternative strategies, we asked advisors to identify the best ways that managers can support their efforts to serve clients and grow their practices. Here’s what they said:

METHODOLOGY

Population

A representative convenience sample of 548 advisors was selected from the SHOOK® Research database of more than 25,000 advisors who have completed surveys with SHOOK® Research in the past. Each advisor participating in the survey was ranked by SHOOK during the past 12 months. The survey population was limited to advisors who rated 5 or higher on SHOOK’s 10-point scale. Channels included were registered investment advisors, independent broker-dealers, regionals, and all major wirehouses.

Questionnaire

The questions were designed using a Likert scale to gauge the intensity of the participants’ opinions. Some questions were short answer or multiple choice. Respondents were asked their opinions and given the chance to offer expanded text answers. Telephone interviews, each lasting approximately 15 minutes, for this study were conducted in July 2025. Interviews were completed with 217 of the 548 advisors who were contacted, resulting in an overall response rate of 39%. In some cases, respondents did not supply answers. As a result, responses were analyzed from 214 advisor interviews.

ABOUT PGIM

At PGIM, we are committed to our clients’ success. We provide access to active investment strategies across the global markets in the pursuit of consistent outperformance.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) — a global leader with more than $1.4 trillion in assets under management (AUM)12 and a company that individuals and businesses have trusted for over 150 years.

Our global scale and specialized expertise in both public and private markets allow us to offer a diversified suite of investment solutions across a broad spectrum of asset classes and investment styles.

ABOUT SHOOK

SHOOK® Research is the world’s leading authority in identifying and elevating the best financial advisors. Each year, SHOOK evaluates over 45,000 nominations and has conducted over 35,000 interviews by phone, Zoom, and in person. The rigorous methodology goes beyond quantitative success, focusing on qualitative impact — how advisors serve clients, lead teams, and raise professional standards. No other research organization or ranking in the world applies this kind of qualitative due diligence. Recognition from SHOOK reflects true excellence in both performance and character. Bolstered by the global prestige of the Forbes brand, SHOOK’s work carries significant influence not only in the United States but worldwide.

IMPORTANT INFORMATION

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended to be, nor should it be construed as investment, insurance, financial, tax, or legal advice, and is not a recommendation. Clients seeking information regarding their particular investment needs should contact their financial professional.

SHOOK® Research, LLC is not affiliated with PGIM, Prudential Financial, or any of its companies or businesses. PGIM commissioned this research and this survey and report was prepared by PGIM and SHOOK® Research. SHOOK® Research does not endorse or recommend PGIM or its investment advisory services. Any views or opinions expressed herein reflect solely the views of the advisors who were surveyed in connection with this survey and, in certain cases, SHOOK® Research and/or PGIM, and such views or opinions are subject to change without notice and may differ from opinions expressed by others. Neither SHOOK® Research nor PGIM has independently verified the information received from the advisors surveyed and no representation is made as to the accuracy of such information. Any projections, expectations or other forward-looking statements set forth herein are based on assumptions that are believed by SHOOK® Research and PGIM to be reasonable as of the date hereof. Neither SHOOK® Research nor PGIM has any obligation to update any such statements. Actual results are inherently uncertain and are subject to many factors, changing market conditions and general economic conditions, and may vary materially from the themes set forth herein. Nothing herein constitutes investment advice or recommendations, and this thought leadership paper should not be relied upon as a basis for making an investment decision.

From Private Credit: An Attractive Alternatives Strategy Case Study (page 12) Risks — Investing involves risks. Some investments are riskier than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. Alternative investments are not subject to the same regulatory requirements or governmental oversight as mutual funds. The sponsor or manager of any alternative investment may not be registered with any governmental agency. Investors are also urged to take appropriate advice regarding any applicable legal requirements and any applicable taxation and exchange control regulations in the country of their citizenship, residence or domicile which may be relevant to the subscription, purchase, holding, exchange, redemption or disposal of any alternative investment. Alternative investments often engage in leverage and other investment practices that are extremely speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested. Private investments are subject to liquidity risk which constitute illiquid investments for which there is not, and will likely not be, a secondary market at any time prior to a public offering and listing of shares on a national securities exchange.

© 2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

There can be no assurance that any investment will achieve its objectives or avoid substantial losses. Diversification does not assure profit or protect against loss of capital. Please be sure to review the details of any investment prior to purchase, including the investment objective, risks, costs and expenses.

These materials are neither intended as investment advice nor an offer or solicitation with respect to the purchase or sales of any security or financial instruction. These materials are not intended to be an offer with respect to the provision of investment management services.

Certain information in this commentary has been obtained from sources believed to be reliable as of the date presented; however, we cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance (or such earlier date as referenced herein) and is subject to change without notice. The manager has no obligation to update any or all such information, nor do we make any express or implied warranties or representations as to the completeness or accuracy. Any projections or forecasts presented herein are subject to change without notice. Actual data will vary and may not be reflected here. Projections and forecasts are subject to high levels of uncertainty. Accordingly, any projections or forecasts should be viewed as merely representative of a broad range of possible outcomes. Projections or forecasts are estimated, based on assumptions, subject to significant revision, and may change materially as economic and market conditions change.

Prudential Investment Management Services LLC is a Prudential Financial company and FINRA member firm. PGIM Investments is a registered investment advisor and investment manager to PGIM registered investment companies. PGIM Private Capital is PGIM’s dedicated private credit asset management business. PGIM is a registered investment advisor. All are Prudential Financial affiliates.

© 2025 Prudential Financial, Inc. and its related entities. PGIM, PGIM Investments, PGIM Private Capital and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

INVESTMENT PRODUCTS | Are not insured by the FDIC or any federal government agency | May lose value | Are not a deposit of or guaranteed by any bank or any bank affiliate.

4886402

1 Cerulli Associates - U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2024, The Great Wealth Transfer: Capturing Money in Motion

2 Bloomberg VIX data, 2023 – August YTD 2025

3 PGIM 2025 H1 Investment Themes, Volatility Boosts Direct Indexing’s Appeal

4 The Cerulli Edge - U.S. Managed Accounts Edition – The Direct Indexing Issue, 1Q 2025

5 7.4% loss harvesting opportunity based on average available losses in the S&P 500 over the past 30 years.

6 Assumes short-term capital gains for top tax bracket of 37% plus net investment income tax of 3.8%.

7 Tax losses may be carried forward on a federal tax level, but not on a state tax level as not every state allows for tax loss carry forward. Clients should consult with their advisor as PGIM does not provide tax advice. Clients may be able to use losses from their Direct Indexing account to offset gains in other investments. After netting out short-term gains and losses and long-term gains and losses, investors have the option to use long-term gains to offset short-term gains (and vice versa). Using short-term losses to offset long-term gains is generally not recommended because the long-term gains are taxed at a reduced rate. Using the short-term losses to offset regular income or carry them forward might be a better use of any short-term losses that might be left over at the end of the year.

8 Cerulli Report - U.S. Private Markets 2025 – Incorporating Private Market Investments into Model Portfolios

9 Cerulli Report - U.S. Alternative Investments 2024, Projecting Retail Alternative Investments Growth

10 Source: Morningstar as of 6/30/2025. All indexes are unmanaged. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Private credit: Cliffwater Direct Lending Index; Bonds: BBG U.S. Aggregate Bond Index; Stocks: S&P 500. Data shown represents quarterly returns for the respective indices going back to 10/1/2015.

11 Structural benefits refer to credit enhancements and deal structures that may help mitigate risks for investors, such as control rights that are typically held by the senior note holders, or guarantor in insured transactions, which will determine the extent to which underlying asset performance can be influenced upon non-performance to improve the revenues available to cover debt service. Credit enhancements refer to strategies used to strengthen the credit risk profile of an investment and are utilized in project financings, public-private partnership transactions, and structured finance to help mitigate risk. Deal structures determine the terms and conditions of the transaction.

12 PGIM data as of 9/30/2025.